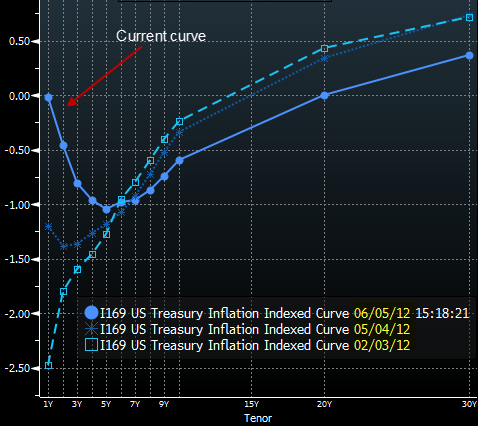

The US TIPS curve has become inverted

By Sober Look

The US inflation indexed treasury curve (TIPS curve) has inverted sharply in the short end. The one-year TIPS yield went from negative 2.5% to zero in a matter of four months. The one-year treasury (nominal) yield on the other hand has held fairly steady near zero (between 12bp and 20bp over the past 4 months). That means that the market is now pricing near zero percent inflation over the next year (down from over 2.6% expected just 4 months ago!) – as near-term inflation expectations collapse. We haven’t seen this since 2009.

TIPS curve now, a month ago, and 4 months ago

One could argue that this is a positive development for the US consumer because it could mean price stability. However this move in TIPS certainly raises the risk of near-term deflation, driven by weak demand growth. And deflation is notoriously difficult to get under control. This feels (though only in the near term) a bit like Japan, a nation quite familiar with zero to negative inflation expectations.

Why is it when there is massive bubble that economist get worried about “deflation” when those prices fall, when it really should be reverting to the long term mean. Hardly deflation. We have had deflation in electronic goods for decades, it has not been counted because they upgrade what is counted. So a 32″ HD TV that would have cost $1000 a few years ago is now $300. That is deflation. When US wages have been stagnant for thirty years shouldn’t house prices revert to a level that is similar to that thirty years ago?

exactly right.

I expect that financiers and their toadies (most economists) understand that when they are levered 20, or 40 or 100 to 1 (does anyone really know? Their was a recent article where an economist looked at all the written material on leverage, and it was all over the place – with so much legerdermain, it is all a crapshoot) know that even the most miniscule fall in asset prices means disaster (well, for them – and in their eyes, and the FEDS, and the government, that’s all that matters. As you say, stagnant or declining real standard of living for 30 years – why doesn’t ANYONE say that is a disaster???)