Policy Uncertainty To Weigh On Turkish Lira

by Win Thin

There seems to be some policy uncertainty brewing in Turkey, which we view as negative for the lira. Today, central bank Deputy Governor Basci published a paper on the bank’s website that suggested a combination of interest rate cuts to limit TRY strength and higher bank reserve requirements to slow credit growth is “the ideal policy mix” to tackle the widening current account gap. The bank next meets December 16, and while the risks of a rate cut then have presumably risen, we do not think a cut is a done deal. Basci has been mentioned as a possible successor to Gov Yilmaz when his term ends in 2011, but we are not sure whether his views are shared by other central bankers. The strong lira is one factor behind the rising current account gap, but so is the strong economy. GDP rose 5.5% y/y in Q3, slower than 10.2% y/y in Q2 and 11.8% y/y in Q1 but still quite strong. The central bank has remained very dovish, and has reiterated that rates would be kept steady until late 2011. Latest central bank survey shows market was looking for 50 bp of tightening over the next 12 months, so the shift to the possibility of rate cuts has taken the markets by surprise and calls into question the bank’s credibility.

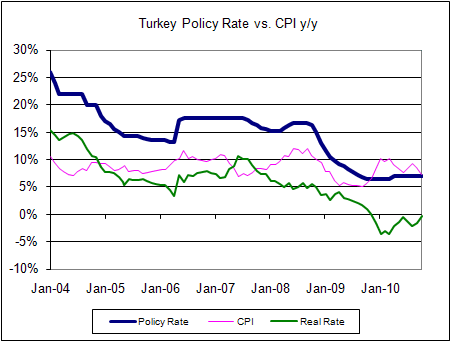

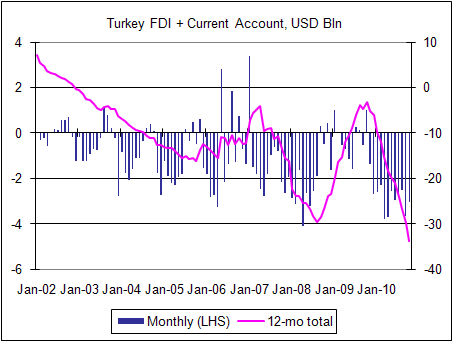

Why? The inflation target for 2010 is 6.5%, and CPI rose 7.3% y/y in November vs. 8.6% y/y in October. The target for 2011 is 5.5% and so while inflation is slowing, the target for next year is ambitious and rate cuts do not seem warranted right now. Consumer loans are growing close to 35% y/y. Indeed, we have always felt that interest rate hikes and reserve requirement hikes are complementary and almost always move in the same direction (see China, India). Moves in the opposite direction just don’t make sense to us. After the November meeting, the central bank warned that capital inflows “pose a risk to the current account balance and financial stability.” October current account gap was -$3.7 bln, bringing the 12-month total to -$40.6 bln. Meanwhile, FDI continues to slow and so the 12-month total of $6.7 bln only covers about 16% of the current account gap. This is down from around 70-75% coverage back in 2009, so Turkey’s concern about hot money flows comes at a time when the country actually needs those flows to finance the current account deficit.

TRY has been one of the worst EM performers vs. USD so far in Q4 (down 4%), and we think this policy uncertainty will keep the lira on the defensive for now. High rates and policy credibility were factors supporting the lira, and now both of those have taken a bit of a hit. Given our defensive view on EM right now, we think TRY is likely to underperform over the near-term. For USD/TRY, key retracement level ahead is 1.5280, break of which would target the June high around 1.6150.

Comments are closed.