Global Growth Is Slowing

By Edward Hugh

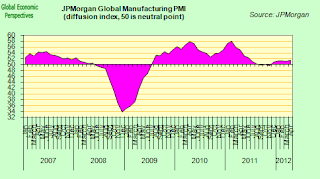

According to the JP Morgan Global Composite PMI report, “Growth of global economic activity eased sharply to a five month low in April.” The authors of the report found that on aggregate across the countries surveyed – 30 across the globe – both new order inflows and job creation fell back, leading them to the conclusion that “the world economy is set for a softer growth patch heading into midyear”. Looking at the chart below, this certainly seems to be the case (the composite index is a measure derived from a weighted average of the manufacturing and services findings).

So momentum is weakening across the entire global economy at the present point, not just in say Europe, or China. Global output is still growing but it is growing at an increasingly weaker pace. What could change that? Well QE3 naturally. Why do I say that? Well look at the three significant surges in the chart. The first coincides with QE1, the second with QE2, and the third, much weaker one, fits in with the so called Operation Twist.

This tells us a number of things. In the first place these massive liquidity injections are not self sustaining, ie they give things a hefty push forward but even so they don’t manage to jump start the various economies, especially in the developed world. They work for a bit, and then run out of steam. The fact that they systematically run out of steam tells me, at any rate, that something somewhere is broken, and that re-iterated injections on their own won’t sort the problem out.

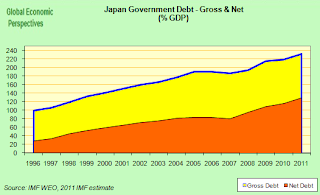

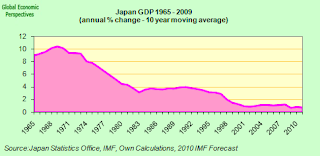

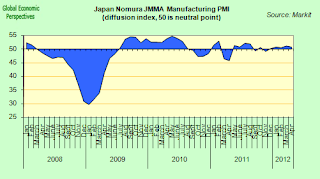

In Japan this very same “something” has now been broken since 1992, and continual liquidity injections and mounting government debt have not made it better. This is not the point to go in depth into what the something is, my story on this is scattered here and there across the various pieces of analysis I write. Suffice it to say that excessive debt and rapid population ageing have to form part of the picture. Both constitute an important drag on growth. But the principal aim of this post isn’t to add to the debate about what it is that broken, it is simply to plead for a recognition that something is, and that, as a result, the situation won’t simply “right” itself. This time there is no hidden helping hand.

What the various liquidity injections do do is buy time. Some people scorn that, and would rather take their Armageddon full face and now. Each to his taste. If I get to die tomorrow and rather than today I am not ungrateful.

Liquidity injections are not quite the same thing as debt generation, although obviously there is a link – injections which involve straight monetisation of government debt (ECB LTRO lending against government guaranteed bank bond collateral in order to enable the bank to buy government bonds, for example) are clearly facilitating the generation of debt. While liquidity provision for its own sake in a deflated economic system is generally positive, debt generation for its own sake isn’t necessarily so, since someone, someday, will have to pay it back, and if in the meantime we don’t fix the problem (that “something” that is broken) then the somebody may be poorer than we are, in which case we are directly transferring income intergenerationally, from them to us. Debt to buy time for something which won’t fix itself is not justified, and the money should be spent structurally, on implementing a fix. Grandiose infrastructure plans which have no real efficiency component were tried in Japan in the 1990s,and they didn’t work.

“Even today, Japan is having trouble climbing out of its cement pit. At its high, in the mid-1990s, infrastructure spending accounted for 6 percent of its gross domestic product, double what the United States allocated for infrastructure in the ’90s and still higher than what politicians are considering spending today. In estimates of national debt, the world’s second-largest national economy is near the top of the list, perched between Lebanon and Jamaica. Last year, Japan’s public debt was far greater than the size of its economy, a burden that makes its demographic challenges more difficult to address”.

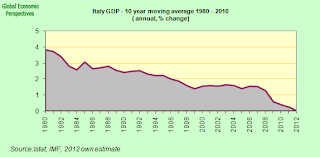

We face a situation which seems neither to have been contemplated in either the Austrian or the Keynesian theoretical frameworks (since both assume some sort of homeostatic corrective mechanism is ultimately at work) or in the any of the various versions of neoclassical growth theory, where some sort of semi-constant equilibrium growth path is assumed to exist, and be recoverable via the application of an appropriate set of structural reforms. Yet the three oldest societies on the planet – Japan, Germany and Italy – have been losing growth momentum for decades now, and it is quite possible will drift into negative average growth rates at some point in a non too distant future. Traditional theory never really contemplated this possibility (for a brief summary of my argument on this, see this recent interview I did with Andrew Pollen).

Now for my second main point. Where’s the missing link? That is, where is the link between the Feds quantitative measures (or those of the other main developed economy central banks for that matter) and global economic momentum? Well, that’s a bit of a longer story – although empirically I think it is easy to see the link is there. Basically the story has to do with international “carry” (borrowing cheap in one currency to lend dear in another, preferably with the value of the first currency falling, and the value of the second currency rising, a set of relations which “carry” itself propagates in good circular fashion), and risk sentiment. The liquidity injection makes people more willing to take on risk (think ECB and the 3yr LTROs), and the existence of the carry trade enables them to do it. Nothing new here, banks by their very nature are about intermediation, and leveraging spreads, its just that in an age of financial globalisation that intermediation has a lot more distant geographical reach.

And then of course, all that extra money helps people from Rio to New Delhi and from Ankara to Jakarta borrow up to the hilt to buy themselves a nice new flat, or SUV, or whatever.

Across Latin America’s largest economy, record prices for the country’s commodities and surging foreign fund inflows – what the International Monetary Fund calls “favourable tailwinds” – are driving a historic boom. Property prices are soaring, consumer credit is booming and bank profits swelling. But there are growing concerns over whether Brazil is becoming addicted to this windfall of easy money. Increasingly, there are fears that Brazil is heading for a bubble.

So excess liquidity which finds no outlet in developed economies floods into emerging markets, provoking unsustainable surges in demand and fuelling inflation, which leads the local central banks to penalise borrowing in one way or another, and bring the whole dynamic to a halt again. At which point we get another liquidity injection in one of the major developed economies, and off we go again.

It is perhaps a sobering thought that households will be about as indebted in Brazil coming in to the next football World Cup as they were in Spain at the time of the 1992 Olympics, and then remember what happened next in the latter case. Brazil isn’t facing a devastating bubble yet, but it could be one day if we don’t find a better way of doing things.

Global Manufacturing In LimboLand

Even if it was services activity, rather than manufacturing, that showed the greatest global weakness during April, manufacturing was only able to gouge out a minimal improvement on what was already a weak March performance, and even then what growth there was was very unevenly distributed.

Overall output, new orders and employment all continued to rise during the month, but there was a marked divergence between the world’s two largest industrial regions, the US and the Eurozone. In fact, the US remained one of the principal spurs of global manufacturing growth in April, with the US PMI rising to a ten-month high, provoking indirectly yet more debate about the desirability of austerity across the EU. Nonetheless, as can be seen from the chart, the surge in manufacturing output remains modest when compared with the two earlier waves, which is why I am among those who think that the arrival of some sort of QE3 is now only a matter of time.

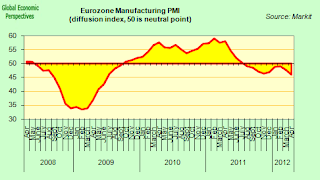

The Eurozone manufacturing PMI, in contrast, posted its lowest reading in almost three years, as operating conditions deteriorated across all of the big-four Euro economies (Germany, France, Italy, and Spain). The US PMI is currently 8.9 points above its Eurozone equivalent, the greatest divergence in favour of the US since Eurozone data were first compiled in June 1997.

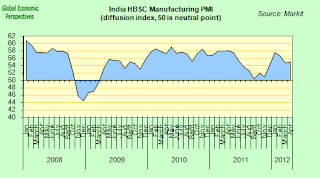

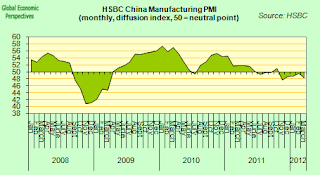

Meanwhile the Asia PMIs remained mixed with solid growth being signalled in India against only modest expansions in Japan, Indonesia, Taiwan and South Korea. Conditions also remained weak to subdued in China. So at this point in time, even the Asian economies as a group are hardly “powering ahead”.

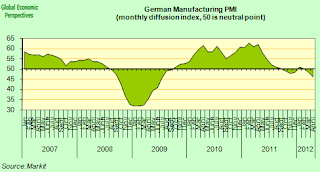

The most marked feature of the April reports as far as Europe is concerned is certainly the way in which conditions in core Europe continue to worsen. As the monthly report said,”the April PMIs also indicated that manufacturing weakness was no longer confined to the region’s geographic periphery. The German PMI fell to a 33-month low, conditions deteriorated sharply again in France and the Netherlands also contracted at a faster rate”. The rate of decline in new orders accelerated, and jobs were lost in German manufacturing for the first time in two years.

Indeed it is the state of the once mighty German economy that is now starting to give cause for concern. The economy suffered a mild contraction in the last three months of last year, and the possibility exists that this will be repeated in Q1 2012, in which case Germany will also be technically back in recession. Whether or not this is the case we will know in a week or so, but either way, the fact that it is a close call, and that things are evidently getting worse as we enter the second quarter certainly undermines some of the force in Angela Merkel’s argument that austerity leads to growth.

As Tim Moore, senior economist at Markit and author of the German manufacturing report put it:

“Germany started the second quarter of 2012 with its worst manufacturing performance for almost three years, as another month of weaker order inflows finally brought production levels back into contraction. With backlogs of work failing to support output volumes in April, manufacturers cut their staffing numbers for the first time since March 2010.

“The investment goods sector was at the forefront of the downturn in April, as jitters about global economic conditions meant clients in export markets sought to delay large scale spending decisions. Investment goods producers saw export orders fall at the steepest pace in nearly three years, and in turn job losses were the most pronounced of the three main market groups monitored by the survey.

Germany’s economy is export dependent. This export dependency comes from having a very high median population age. It is not a cultural quirk of the Germans. There is no fundamental issue with German competitiveness, there is not some major structural reform that is missing, there is not even over indebtedness in the public or private sectors. The only reason the German economy has fallen back into recession is that demand for its products among customers has dropped off, while the long awaited second pillar of domestic demand has once more failed to appear. It is as simple as that.

With the results of the recent French elections in the forefront of their minds, people are now starting to ask themselves just how Germany will respond to a Francois Hollande Presidency, forgetting that elections are also looming in Germany next year, and that the CDU is busily loosing ground. Whether or not Germany technically confirms a recession when the results for the first three months of the year are out in a week or so, the performance of the economy is visibly worsening and German leaders are under pressure to show they are willing and able to respond. Otherwise Angela Merkel may face wrath not only from those irritated by the having to contribute towards the bailouts, she will also have to contend with those irritated by her economic ineffectiveness back home. And in any event, the party which would gain from a Merkel electoral defeat – the SPD – are not that far from seeing things the way Monsieur Hollande does.

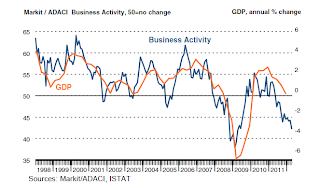

Which is why Angela Merkel’s approach was always far too simplistic. As I have said a number of times, I think she he right to search for some sort of financial stability in the face of the ageing population issue, but the best way to get from here to there is not necessarily to walk in a straight line. Naturally, austerity is a relative concept, but whether you are cutting your deficit from 10% to 9%, or from 3% to 2% as you go into a recession you still hit short term growth with a double whammy, as Italy is currently discovering. As can be seen in the chart below (which is the April Italian services PMI) domestic demand is plummeting on the back of the latest round of austerity, and this is leading the main centre left party in the government to at least cry ouch!

At the very least European fiscal policy needs to allow for a counter cyclical component, even as you pull back from a very high deficit level, and not, as at present, insist on an entirely pro-cyclical one in a recessionary environment, thus magnifying the amplitude of the demand swings. If an economy needs more than 5% deficit (or more than 10% for that matter) simply to get meaningful GDP growth, then you need to understand why this is and find solutions, since as I say above debt itself doesn’t cure anything, and arguably as our populations age accumulated debt only makes things worse. But if one of the engines on the plane starts to malfunction, the objective needs to be to get the passengers to the ground safely, and not necessarily by the most direct route.

Naturally infrastructure work on the periphery which needed German technology would help German export companies, so it wouldn’t be that hard to sell in the heimat. But what use would it be to the receiving countries? That we won’t know till we see the proposals in detail, and discover how it is going to be financed. If such infrastructure would help exports, both within and outside Europe, then it could be a plus. If it is only to built high speed train networks that lead nowhere (or as is currently under discussion in Spain up to a frontier with Portugal across which there will be no connection waiting the other side) then we are simply falling into the Japan trap, and applying a simplistic 1930s version of Keynesianism that doesn’t work in the present context. But at the end of the day, the fact we are having this debate in the first place only serves to highlight the fact that we still don’t have a roadmap for coming out of the crisis in Europe, and we still don’t know what our future is going to look like.

And meanwhile, of course, there is Greece, and that blasted ongoing economic contraction to think about.

As Paul Smith, Senior Economist at Markit and author of the Greece Manufacturing PMI report commented:

“April proved to be another difficult month for Greek manufacturers, with latest data again showing steep contractions across a number of key variables measured by the survey. “In line with recent reports, the issues facing manufacturers – and the Greek economy as a whole – remain deep rooted. Panellists again noted problems in accessing working capital and a culture of cash payments, implying that credit lines remain either closed or that agreements will come with restrictive terms.

“At present, it remains hard to see how these issues can be solved suggesting that the manufacturing sector is set for continued struggle in the months ahead.”

Following his cue, and looking over at the latest election results in that unfortunate country, it remains hard to see how the issues arising can be solved, and it isn’t clear what gets to happen next.

This post first appeared on my Roubini Global Economonitor Blog “Don’t Shoot The Messenger“.

Comments are closed.