Italy Braces Itself For The Full Monti

by Edward Hugh

This post first appeared on my Roubini Global Economonitor Blog “Don’t Shoot The Messenger“.

The Italian government, Mario Monti informed the country’s parliament last Thursday, is now planning to concentrate its attentions on achieving economic growth. A timely decision this, since the statistics office announcement a day earlier that the country had once more fallen back into recession, while not being a surprise nonetheless does constitute a cause for concern.

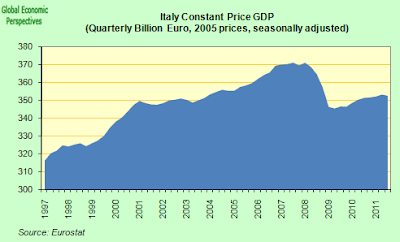

Not that Italy is any stranger to recession, since the country has now had five of them since entering Europe’s Monetary Union at the turn of the century. In fact the Italian economy has now contracted in eight of the last 15 quarters, and GDP is back in the good old days of 2003, stuck below the level it first attained in the first three months of 2004. And of course it is now going backwards in time again. Depending on the depth of the recession now being provoked it is touch-and-go whether the economy might not at some point even revisit levels last seen in the closing years of the 1990s. And remember, this is not deflation ridden Japan, this is real, not nominal GDP we are talking about here. So far Italy hasn’t been experiencing deflation, or at least not yet it hasn’t.

All in all, it would be hard to say that the Euro has worked well for the Italians. Maybe it was a great opportunity that the country was unable to take advantage of, but in any event all they are going to see from here on in is the downside part of it. The inability to adjust the value of a domestic currency they don’t have to compensate for all that wantonly lost competitiveness means they are going to have to do things the hard way, subjecting themselves to a collective ingestion of cod liver oil the like of which the country has not seen since the harsh days of the1920s.

Sinking Below Ground

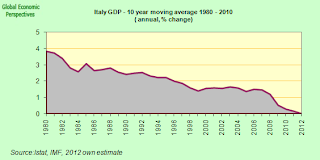

The extent of the problem the country now has can be easily seen in the chart below, which shows annualised growth over a decade (as a moving average). What is absolutely shocking is that in the ten years up to 2010 Italy had an average annual growth rate of just 0.28%. Assuming growth of about 0.5% in 2011 (which may now be generous), in the decade to 2011 this will drop to 0.15%, and if we pencil in a contraction of 1% in 2012 (perfectly realistic, in fact it will probably be worse) then the number turns negative. That is to say, on average the Italian economy will have shrunk every year for a decade.

Some may say that this result is in part a by-product of the global crisis, and they would be partly right. But look at the trend over the last three decades, far from seeing some stylised version of steady state growth hovering around a constant mean, the rate of expansion in Italian output has been heading relentlessly downwards, so logically it was always bound to cross the zero line at some point. That point now seems to be about to arrive in 2012, a year which may mark a before and after in modern Italian history.

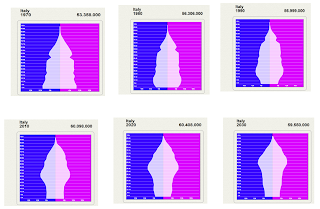

Naturally, the reason why Italian growth has fallen so far is the big point at issue here. One of the reasons is obviously a competitiveness loss resulting from higher than Eurozone average inflation sustained over a long period, but another component is possibly the impact of population ageing, which has hit Italy more than any other European country except for Germany, and it is with Germany, of course, that Italy has the largest competitiveness loss. Demographically speaking Italy is Germany minus all that export competitiveness.

Looked at from another angle, like many other countries Italy probably grew rather over trend in the years between 2004 and 2007, and then dropped back sharply in 2008. But the Italian economy fell further than most of its peers, and subsequently really failed to recover. This is the clearest demonstration of the competitiveness problem, and it won’t be easy to address.

It’s The Competitiveness, Silly!

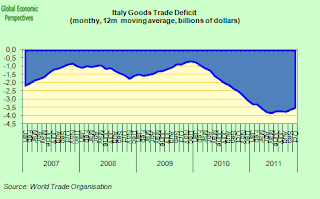

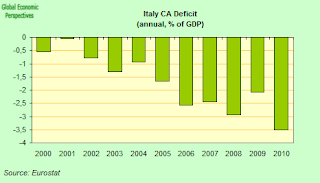

As is well known Italy is weighted down by a massive burden of public debt (120% of GDP). Even before the recent surge in Italian bond yields servicing this debt consumed an onerous volume of government income. But this debt alone does not explain why Italy has such a poor track record. Japan, for example, has a debt burden of over 200% of GDP and still manages to eke out a better growth trajectory. The two countries are similar in that domestic demand is permanently weak (they both have elderly populations, with a median age of around 45) yet difference between the two countries is obvious, since Japan (like Germany) has a large and dynamic export sector which generates a trade and current account surplus, and this buoys investment and GDP growth. Italy, on the other hand, has a trade and current account deficit, and both of these have been worsening since the end of the last recession.

Naturally a negative trade balance weakens the GDP reading, given the impact of the net trade effect, but curiously the recent GDP slowdown has been associated with a drop in government spending (which is what previously had been sustaining Italian GDP in positive territory), a fall in domestic consumption, and a consequent fall in imports (which is why the trade balance has been improving somewhat of late). Indeed, the reduction in imports meant that the net trade effect was one of the few positive points in the latest GDP reading – even while the economy contracted by 0.2% net trade added 0.8 percentage points to what would otherwise have been a devastatingly bad number. So there is no need to call in inspector Clusot to find out what happened, it was clearly the sharp cut in government consumption that finally killed off the fragile Italian recovery, although naturally, given that government debt was – and has been for some years – on an unsustainable path, the spending tap had to be shut off at some point. What Italy now needs – like so many of the countries on the EU periphery – is a sharp improvement in international competitiveness and a significant surge in investment into the export sector. The two of these naturally go together, since few will invest in activities which are unlikely to be competitive and profitable.

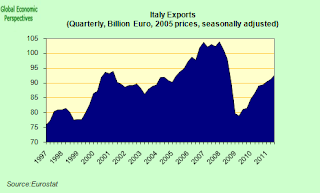

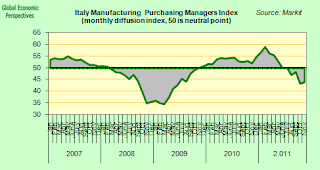

Italy does have a stronger export sector than some of its Southern European counterparts, and exports did surge as the global economy started to recover (see chart above), but they never managed to reach their pre crisis level, and now, at least according to the latest PMI surveys, they are weakening once more as the European and global economy slows.

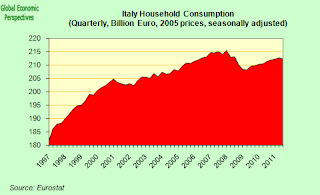

Italy was far from having a consumer boom during the good years of the first decade of this century. In fact household consumption grew by less than 5% between 2000 and 2008, and in any event the pace was much slower than in the 1990s (see the shift in steepness of the slope in the chart below).

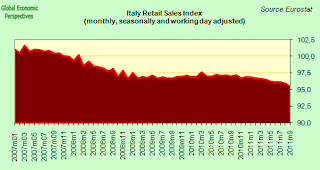

Retail sales have been falling since 2007.

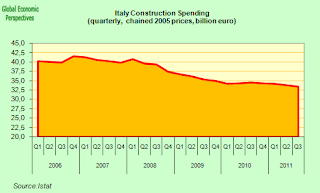

And construction spending has been one steady slide down.

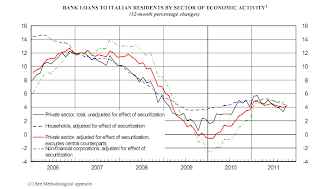

And yet, despite all the pressure on Italian banks there is (as of October) no sign yet of a sharp credit crunch affecting either firms or households, since private sector credit is still growing at an annual rate of around 4%, a stark difference from the picture in Greece, Spain, Ireland and Portugal where private sector credit is steadily contracting.

No Boom, No Bust

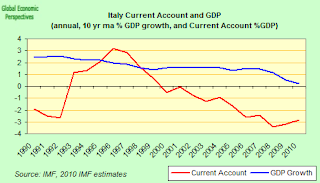

So to be clear, Italy did not have any sort of housing or credit driven boom during the first decade of the century, Italian households and companies are not massively in debt when compared with their Euro Area peers, and credit is not in especially short supply. Ageing population dynamics lead domestic consumption to be weak in Italy (following a pattern which is strikingly similar to that seen in Japan and Germany), yet Italy’s export sector has been allowed to drift as competitiveness has been lost. Really the most telling chart I have is this one, which shows how as the current account surplus has widened (ie as competitiveness has been lost) long term growth has steadily declined.

With neither exports nor private consumption able to pull the economy the state has been under constant pressure to offer support via deficit spending, leading to the accumulation of an unsustainable quantity of government debt. This deficit spending is about to come to an end (permanently according to the latest EU agreement), and under these circumstances the economy is likely to remain in or near contraction for as long as it takes to recover competitiveness. The question is, how long is that going to be, and what will happen to the debt dynamics in the meantime.

To take the second question first, one of the reasons that many are confident Italy will make it on through with the debt challenge is the country’s recent record in controlling the deficit. According to OECD data, while Italy ran a cyclically adjusted primary deficit every year between 1970 and 1991, it ran a cyclically adjusted primary surplus every year since 1992. That is to say, before allowing for interest payments Italy has not been running a deficit for many years now, and it is simply the burden of servicing the accumulated debt which is causing the country to spend more than it receives in revenue. As many of those who are in the “optimistic” camp on the question of the country’s ultimate solvency eagerly point out, Italy’s cyclically adjusted primary balance as a proportion of GDP has remained in a better shape than those of the largest developed countries as well as those of European peripheral and core countries since the onset of the crisis. It is only the legacy of the past which acts like a dead weight pulling the country down, but what a legacy this is, and especially as yields on Italian debt have steadily risen.

Poised On A Knife-edge

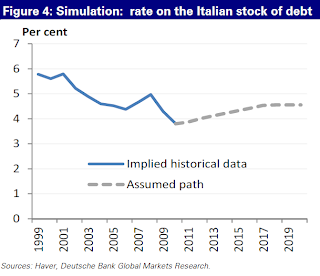

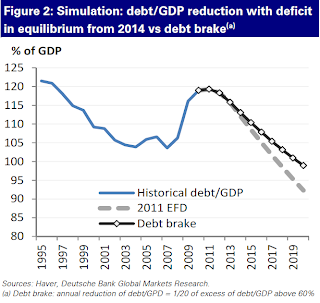

But given everything it is clear that Italian debt, and with it the future of the Euro, now sits poised on a knife edge, as is illustrated in the chart below (which comes from Barclay’s Capital). If you take a neutral scenario where Italy has a balanced budget and a sum total of zero nominal GDP growth (ie growth+inflation = 0) debt stays put at 120% of GDP out to infinity.

But then imagine the average finance cost of Italian debt rises, and stays high. In this case the only way to compensate is by running a larger primary surplus (ie more spending cuts, or revenue increases to compensate for the extra interest cost). The net effect of this would either be to generate deflation or a more sustained economic contraction, in which case debt to GDP would start to rise indefinitely. Think of it like this, either prices fall by one percent and GDP (via exports) rises by 0.5% (for example), in which case nominal GDP falls 0.5% a year (the Japan type case), or prices rise by 0.5%, exports lose more competitiveness, and so growth falls by 1%. I mean, this example is only illustrative, but it is meant to give some sort of feel for what “knife edge dynamics” really mean.

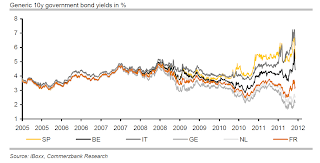

In fact, before the recent surge in the spread, average interest costs on Italian debt had been falling in recent years, but now they are evidently rising again. It is very important here to remember that yields in bond auctions only affect new emissions of debt (and changes in the secondary market only really affect banks, and sovereigns through possible needs to recapitalise banks). So it is a question of years before the higher levels “lock in” – the average maturity on Italian debt, for example, is around 7.2 years, and indeed since governments finance at fixed and not floating rates (not at a certain % above 3 month Euribor, for example), debt costs are at much at risk from increases in ECB base rates as they are from the actual spread with German bonds. Any substantial increase in interest costs naturally makes selling debt more expensive. Fortunately for peripheral sovereigns, the likelihood of ECB rate rises in the foreseeable future is near to null.

No Way Back Home

But again, let’s do another thought experiment. Imagine I am right, and Italian debt is on a knife edge path, and suppose the average interest rate on the whole debt creeps up by 1 percentage point. With debt at 120% of GDP, then the primary surplus to cover the added interest costs and maintain a balanced budget would be 1.2% of GDP. But suppose, for the sake of argument, that increasing the primary surplus by 1.2% pushes Italian debt to gdp up to 125% (via a combination of either deflation or economic contraction), then the next year the primary surplus would need to be up by an additional 0.05%, helping force debt to GDP up even further and so on and so forth. This is why people call this the debt snowball. The point is, whichever way you turn, you seem to find the exit door locked.

Coming back to the details of the present situation, the Italian government has committed itself to a consolidation program worth €74bn over the next two years amounting to roughly 3.7% of GDP. This is designed to bring the budget into balance (or the deficit to zero) by the end of 2013. On quite conservative assumptions, just to tread water, and maintain the debt level where it will be in 2013 (which will be more than 120% of GDP due to the recession), Italy will need a primary surplus of 2.3% of GDP.

But then we need to think about the recently undertaken commitment to reduce the debt (the last EU summit). The exact numbers have yet to be agreed for the new pact, but it looks like a cyclical maximum of 0.5%, and (even more importantly) a commitment to reduce outstanding debt over 60% of GDP by 5% a year. This, in Italy’s case will mean the country is going to need (from 2014 onwards) a primary balance of something like 5.5% of GDP (depending on the evolution of interest costs) over the rest of this decade. Which means the Italian economy is going to face an even more restrictive fiscal environment.

Now, those who argue the Italian crisis will have a happy outcome point to history, and argue that Italy was able to achieve a primary surplus of around 5% on average during the years 1995-1998, so why shouldn’t the country be able to do this again? The main counter argument would be that that was then, and this is now. That is to say, these were the years of Italian “coupling” with monetary union, sizable privatisation programmes, falling (not rising) interest rates, and basically Italian trend growth had not fallen as far as it has now.

Moreover, the external environment in Europe will not exactly be conducive to boosting exports. Even core Euro Area countries are committed to undertaking additional fiscal consolidation beyond what is currently envisaged in order to comply with the new debt rule. Taking 2014 as the starting point, debt to GDP for the Euro Area as whole might be something like 90%. Hence the 1/20th rule would imply that on aggregate the Euro Area will need to reduce its debt ratio by around 1.5 percentage points per year. If this agreement is complied with the adjustment will almost certainly imply a net fiscal drag on growth in the years following 2013. Of course, if it is not complied with then it will almost certainly be “bye bye Euro” (assuming the common currency still exists that far up the road).

It’s All About Structural Reforms, Or Is It?

So basically, what the whole argument about whether or not Italy can make a final burst and reach the finishing line is all about structural reforms, and whether the country can get enough growth (quickly enough) to turn the “knife edge trap” around. Personally I am extremely doubtful that it can, which is why I placed so much emphasis on the growth performance in the first section. The turnaround needed here is massive. It is a 30 year decline we are talking about, and I doubt short of outright default and substantial devaluation we have historical examples of anyone doing this. The adjustment made in Germany between 1999 and 2005 was much smaller in comparison.

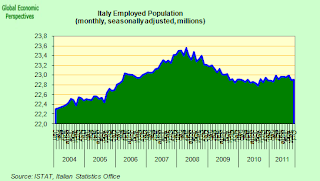

One of the proposals is to introduce labour market reforms to increase participation rates, but in fact the Italian labour force grew substantially between 2004 and 2008 (due to large scale immigration), with employment being up by over a million (or around 5%, see chart above), yet the increase in output was ridiculously small. On the other hand we know the Italian working age population is contracting (and the average age rising), while the elderly dependent population is increasing rapidly. Conventional economic models tend to be silent on this issue, but common sense should tell us that this is going to take its toll on growth – a factor the “structural reform answers all our problems people” don’t seem to have given enough thought to.

The Monti government needed just five weeks in office to push through an additional 30 billion-euro emergency budget package, but how long will he need to get GDP growth back up above 1% annually? And how much time does he have? Investors initially cut him some slack, but judging by the reaction to the final approval of the package by the Senate – the yield on Italy’s 10- year benchmark bond was pushed up by 12 basis points to 6.91%, dangerously close to the key 7% level (although still somewhat below the Euro era record hit on November 9, just before Monti took charge). 7% is widely considered to be critical if sustained for any great length of time, partly due to the cost of debt servicing but also because of the level of dependence of Italian banks on the ECB that it would produce.

Till The Downgrades Fall

So the “Full Monti” effect now seems to have been priced in, while investors nervously wait to see what the real plan for Spain and Italy actually is.

The first quarter of 2012 looks to be critical for Italian debt, with about one third of the total Euro Area debt maturing being Italian. Indeed the battle starts this week with the Treasury having to sell an assortment of T-bills and 2 year and 10 year bonds. In addition the Italian government is now increasingly guaranteeing bonds issued by Italian banks to be used as collateral at the ECB – with about 40 billion euros being issued last week according to some estimates. So effectively Italy is now more or less guaranteeing the banking system with the likely outcome that ratings agencies will be even harder on the sovereign rating.

Not that the outlook was exactly bright on that front anyway. Understandably, Italy was among the 15 Euro Area countries Standard & Poor’s placed on review for a possible downgrade on December 5. This follows an earlier downgrade to a single A by the agency in September. In addition, Spain and Italy were both warned by Fitch (which cut Italy’s rating to A+ in October) on December 15 to brace for a further debt downgrade after concluding that a “comprehensive solution to the eurozone crisis is both technically and politically beyond reach”. And to complete the set, Moody’s, which cut the country to A2 on October 4, maintained a negative outlook, signifying that a further downgrade in the coming months was highly probable The bottom line is that Italy is both too big to fail and too big to be bailed out, which is why it is still hanging dangerously in limbo-land. Since, as I argue in this article, some sort of restructuring or other is well nigh inevitable in the Italian case, the sooner Europe’s leaders work up a credible plan on how to achieve this, the better. Otherwise it will not only be Italy’s citizens who are subjected to the Full Monti, Europe’s leaders may also find themselves with their credibility stripped naked.

a good summary but missing two key things

1) the energy deficit (70 billion every year is not peanuts)

Italy has no nuclear power as France (houch 50 plants fukushima events???) or Germany

2) interest on public debt

Italy entered in the ‘euro with a huge debt

Note that at the same time the German and French public debt has exploded more than doubled

From this point of view the ‘Italy did better than all other countries

The Italian debt is the same as 20 years ago

“What Italy now needs – like so many of the countries on the EU periphery

– is a sharp improvement in international competitiveness and a

significant surge in investment into the export sector.”

Is this just another way of saying that Italian workers need to be paid less? How does this happen without lessening the parasitically nature of a bloated banking system?