ECB: A Shift from Hawkish to Neutral?

BBH CurrencyView

- BoE holds steady, with markets awaiting the ECB press conference; European stocks firmer

- Important speeches from Bernanke and Obama; Bernanke likely to signal potential measures

- Brazil swaps and futures market pricing in significant rate cuts; BoK left rates on hold at 3.25%

European equities reversed opening losses to trade 1% higher on the day for the Euro Stoxx 50, supported by expectations of further policy stimulus head of the ECB Governing Council meeting and President Obama’s speech tonight.Expectations of further monetary liquidity also boosted demand for yield in the fixed income space with US and German 10yr yields falling 5bps and 3bps respectively. Meanwhile improved capital market liquidity conditions and perceptions of easing political risk and the Italian parliament approved austerity measures and the Germany’s high court approved Germany’s participation in EU bailouts continue to benefit peripheral conditions, although government bond performance remains mixed. French 10yr benchmark government bond yields are down 8bps and Italian yields have also retreated 1bp to 5.21%, with Greek yields pushing new highs.

Markets are likely to be focused today on policy decisions from central banks and important speeches from Bernanke and President Obama. With the OIS markets beginning to price in a 25bps cut by the ECB over the next year, it appears that the market is anticipating a shift in the ECB’s tone from hawkish to neutral. Some observers seem to think that while the economic picture continues to deteriorate rapidly in the EZ a policy response is required by the ECB to help support both the core and periphery economies. In fact, over the past month EZ economic data has been the absolute worst global performer (comparing the actual and expected economic data responses) with most recent downside surprises nearly four standard deviations from consensus. That said, it will be interesting to monitor the press statement for signals that the risks to price stability are now “balanced.” To us, a change in the message would likely signal a shift from a hawkish to more neutral tone and as a result could lead policy makers to widen the interest rate corridor, which is tantamount to a form of easing. All told, we suspect that the risks for the euro are to the downside, with a break of the 200dma (1.4025) paving the way to test $1.384. We also doubt that the euro is likely to gain much traction from a hawkish message since it would likely elicit a negative market response amid the ongoing tensions in the EU banking sector. Outside the EZ, the markets will be focused on speeches from Bernanke and Obama to determine the potential combination of fiscal and monetary stimulus in the US. We doubt Bernanke will announce any big but we expect he is likely to attempt to manage expectations for the policy response that may be expected at this September’s meeting. President Obama is expected to announce a package to stimulate the US economy through a combination of personal and business tax cuts, infrastructure spending and direct aid to states. We expect the bar to be quite high and thus think that Obama will need to deliver something beyond market expectations to elicit a positive response from risky assets and in turn soften the dollar.

In the EM space, Brazil swaps market pricing in significant rate cuts over 1 year to 10.75% vs. 12.0% currently, which would reduce BRL attractiveness. This expected rate path is also indicated as the most likely path, implied through listed interbank deposit futures. In fact, the listed futures suggest that the rates are likely to decline by nearly 150bps by March of 2012. To us, this seems way too dovish but stranger things have happened. Some observers might wonder how the bank would react if weakness in the real becomes self-fulfilling and starts to add to inflation pressures. In any event the market sees 50bps cut on October 19, which combined with the recent market stress is likely to keep the real on the back foot. Chile’s central bank today just lowered its 2011 and 2012 inflation forecasts. Swaps market pricing in only 50 bp of easing over 1 year, think this may understate potential cuts in Chile. Meanwhile, the Bank of Korea BoK left rates on hold at 3.25% as expected, citing global uncertainty and warned that the economy was facing a soft landing. Otherwise, the UK expects China to declare its support for London to become an offshore trading centre for the yuan, the FT said today. UK Chancellor, Osborne, is preparing to hold talks with Chinese Vice-premier Qishan and British officials say China will back the private sector’s interest in yuan trading in London. The step would pave the way for global investors that want currency diversification and more exposure to China to trade yuan. Hong Kong is currently China’s main offshore yuan center, and the CNH market has seen considerable growth. The pool of deposits denominated in yuan in Hong Kong, has exploded in the past year, and will likely reach 10% of total deposits before the end of 2011.

|

Data Reports |

||||

| Time | Country | Report | Survey | Prior |

| 8:30 | US | Trade Balance | -51B | -53B |

| 8:30 | US | Initial Claims | 405K | 409K |

| 8:30 | US | Cont. Claims | 3706K | 3735K |

| 8:30 | CA | Bldg. Permits | -1.50% | 2.10% |

| 8:30 | CA | New Housing Price m/m | 0.30% | 0.30% |

| 8:30 | CA | Trade | -1B | -1.56B |

| 9:00 | MX | CPI m/m | 0.21% | 0.48% |

| 9:00 | MX | CPI y/y | 3.49% | 3.55% |

| 9:00 | MX | Core CPI | 0.15% | 0.22% |

| 15:00 | US | Cons. Credit | 6B | 15B |

| 19:00 | PE | Reference Rate | 4.25 | 4.25 |

| Economic/Earnings Events | ||||

| Time | Country | Event | ||

| 7:30 | BZ | COPOM Policy Minutes | ||

| 8:45 | US | Geithner to speak | ||

| 13:30 | US | Fed’s Bernanke to speak | ||

| 19:00 | US | President Obama to speak |

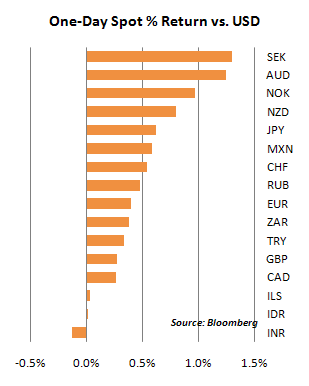

Daily Currency Performance

Comments are closed.