Policymakers fear the Italian penalty shot

By Edward Hugh

“While the impact of service-sector liberalization and privatizations may be positive on medium-term growth, the budget cuts are likely to have quite negative effects on the short-term GDP dynamic. We expect Italian GDP growth to slow to close to zero in 2012 and 2013.” — Giada Giani, Citigroup

According to one anonymous German official speaking off the record to reporters from Der Spiegel, “a country like Italy can’t be saved”. We will have to trust that he was referring to the country’s size when he made the statement, and not its existential core. If he was, he may well be right, at least under the Euro Area’s current institutional arrangements. Let’s take a quick look at why.

The ECB Backstop Works For Now

The Italian debt markets are a lot calmer this week than they were the week before last. Evidently there is a simple explanation for the phenomenon, and that is that the level of Italian bond yields is now more or less completely guaranteed by the European Central Bank (the ECB). Systematically and meticulously, the Italian ten year bond yield is being maintained at or around the 5% level by a team of dedicated bond traders in national central banks dotted around the Euro Area.

The process whereby this result is achieved is not that dissimilar to other more common central bank interventions, for example to target a certain exchange rate, or a given overnight interest rate. Basically, when the yield rises above a given threshold the ECB’s representatives simply step in and buy bonds. This happened last week to the tune of some 22 billion euros, with bonds being acquired from a set of 5 EU peripheral countries, although we don’t know how the purchases were broken down at national levels. One thing was for sure, there were a hell of a lot of Italian bonds tucked in there somewhere.

The problem for the bank now is that once you initiate a programme like this, there is no easy way to stop. Despite many voices who argue the contrary, Italy’s problem is not simply a short term liquidity one (funding a deficit), it is a long term solvency one (servicing an enormous pile of debt and growing at the same time). While the country has long maintained a primary surplus, the weight of the debt has drifted steadily onwards and upwards. Italy is caught in a conundrum. With low growth you need inflation to be able to make the books balance, but this excess inflation makes the country’s competitiveness problem steadily worse. If you implement the reforms needed to make the economy more competitive then you don’t get the inflation, and if you take away the deficit in the meantime then you simply don’t get growth. This is a zero sum game in which all the numbers don’t add up.

At the push of an ECB “buy” button, Spanish and Italian sovereign bonds have effectively been taken out of the markets, and it is now hard to see how (without some sort of restructuring or other) they can now ever get back in again.

In ceding to pressure from Europe’s leaders to take this decision, the central bank has now gotten itself locked onto the horns of a huge dilemma, and they are going to have great difficulty finding a way to extract themselves from it. Monsieur Trichet has lodged his finger well and truly inside the wall of the dike, and should he even momentarily take it out again, the whole structured could easily rupture, with many of the things we now know and love getting carried away in the ensuing flood.

Of course, the mere threat that he might one day do this does serve to concentrate all the various minds involved, but what is involved is a form of brinksmanship which could in itself one day become a problem.

A glimmer of what the bank is now getting itself involved in can be seen in last week’s ECB balance sheet reading, since it grew to the year-to-date high of 2.073 trillion euros last, largely as a result of increased lending to eurozone financial institutions and additional sovereign bond purchases.

The balance sheet was up by 68.736 billion euros over the previous week, and 119.94 billion euros over the same period one year ago. In part the balance sheet surge was due to an increase in net lending to credit institutions (which increased by 98.3 billion euros to 393.3 billion euros). And in part it was up due to the 22 billion euros spent in bond purchases. Curiously the weekly fixed term deposit levels remained unchanged at 74 billion euros (the quantity spent in periphery bond purchases to date), which sort of settles the issue of whether the bank were going to “sterilise” the new purchases, or create additional money to pay for them. For the time being at least they seem to be doing the latter, since going by the size of the banks current account holdings (which jumped to 286.783 billion from 159.814 billion euros a week before) they seem to have offset the purchases through money creation.

Basically central bank bond purchase intervention is deemed to be “neutral” in monetary policy terms if an equivalent quantity is drawn back from the banking system by attracting new term deposits at the central bank. That the bank may be carrying out a “money printing” exercise (and especially one to monetise the debt of certain countries in particular) is raising fears of impending inflation. My feeling is that, in the context of heavily over a leveraged private sector and congenitally weak domestic demand, this is not a real concern at present for the Euro Area. I think the ECB’s own inflation alert was always overdone, since most of the inflation we have seen of late has either been imported (via rising energy and commodity prices) or administratively generated via consumption tax increases. There has been very little in the way of second round effects.

The real worry then should not be inflation, but whether or not the Italian government will ever be in a position to honour the bonds in full, and on time. At the present time this is only a theoretical question, since additional bond purchases can always enable the Italian state to meet its obligations, with the ECB facilitating debt rollovers by using the commercial banks as proxies in the primary markets. But just how deep in do you want to get? At the present time the bank owns something like 20% of outstanding Portuguese, Irish and Greek debt. 20% of Italian debt would be something like 380 billion euros, a volume of bonds which would already be difficult to pass over to the EFSF (or its heir the European Monetary Fund). But in this case the force of tradition is not strong, and there is no real reason why the bank need stop at 20%. The sky could be the limit, and the ECB could be transformed into the new Bank of Japan, effectively light years away from the earlier visions of the Bundesbank founding pioneers. And, of course, we would all be into one of those processes which can go on for just as long as they can.

The Balanced Budget Amendment

At the heart of the recent ECB decision lay something known as the balanced budget amendment. First introduced in Germany in 2007, this is a constitutional change which (in the German case) makes a deficit of over 0.35% of GDP illegal as of 2016. One of the conditions the ECB imposed on Italy was that they also change their constitution, but in this case outlawing deficits as of 2013. Effectively, and at a single stroke, this brings to an end a whole era of Keynesian counter-cyclical fiscal policy and economic management. So the implications are large, and hard to separate from the rapidly ageing population phenomenon.

While it was the size of the latest package of cuts which hit the headlines (Rome orders €45bn in cuts and taxes), the key issue was really the balanced budget amendment, since this has one clear implication: as of 2013 there will be no new bonds. So at least now the outer limit of ECB exposure is a known fact.

Chronicle Of A Crisis Long Foreseen

While the Italian crisis may have crept up on markets all at once and unexpectedly, issues about the sustainability of Italian debt are not new. As FT Alphaville’s Joseph Cotterill noted when the latest wave in the Italian crisis broke out: “In the original ‘why the eurozone will break up’ papers of the 1990s and early 2000s, it was never ever high Greek deficits, or Irish (or Spanish) bank losses going on to public balance sheets that were forecast to destroy the single currency. It was always Italy. High-debt, low-growth, Italy”.

Exactly, Italy was always the greatest worry on everyone’s minds, including the ECB’s. Indeed, the now long forgotten minimum rating requirements for collateral posting at the bank were first muted by them with precisely Italy in mind. I myself wrote one blog post after another (see links below) warning of the danger which was looming, buried in Italy’s toxic combination of low growth, rapidly ageing population and high accumulated debt. It was simply a crisis waiting to happen, and now it has. As the New York Times’ Landon Thomas noted in the Blog Prophet of Eurozone Doom article he wrote about my work, “Mr. Hugh’s demographic thesis is not airtight: in fact, it was Italy, not Greece, that attracted his early attacks. But Italy, perhaps because its overall debt level was already so high and its population was older, pursued a policy of greater fiscal rectitude than its neighbours and avoided a real estate bubble”.

Not airtight, but nearly-so it seems, since behind the short term obsession with fiscal rectitude there lie the longer term preoccupations about solvency and debt. And here Italy (and eventually Japan) jump right back into the cockpit. As Landon mentions, Italy didn’t have a housing boom worthy of mention, so private debt didn’t surge during the first decade of the century, and during the crisis Finance Minister Tremonti pursued a policy of flying under the radar by keeping deficit spending low. But now short term deficit issues are waning, and longer term solvency questions are surfacing in the wake of the renewed Greek crisis. Thus, while historians of the future may well struggle to understand just how it was that a simple fiscal deficit bailout programme was so badly handled that Greek sovereign debt shot up from around 110% of GDP entering the crisis to around 170% by the end of the “rescue” period (and this without even having enjoyed a real housing bubble, i.e. with a private sector that was not massively in debt), the Italian case will raise few eyebrows, since every thinking economist had seen it coming for so long (Japan too, see my Italy blog here, here, here and here).

Low Growth and Ageing Workforce Are A Troubling Backdrop

Italy’s problem is not its fiscal deficit, in fact in every year since 1991 Italy has run a cyclically adjusted primary balance (that is before interest payments are taken into account), it is the weight of the accumulated debt burden and low growth. The country’s trend growth rate has been falling for decades, and during the first decade of the present century it only managed to grow at an average rate of about 0.6% per annum.

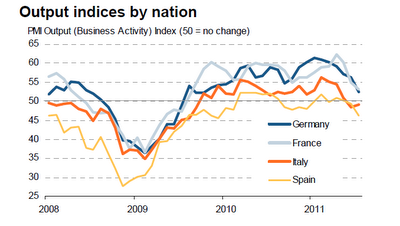

Even though the quarterly GDP growth rate accelerated slightly in Q2, and reached a quarterly rate of 0.3% (up from the 0.1% expansion achieved in the first three months of this year), the slowdown in core Europe, and the readings on the most recent PMIs leave little doubt that the respite will be short lived. At this point even the current IMF forecast for modest 1% GDP growth in 2011 is looking very optimistic. And if the country now slips back into recession (certainly not excluded) then the under-performance would be much greater.

The worrying thing is how Italy has been able to get so little growth out of so much. This is especially the case when you take into account the fact that during the last decade the country’s labour force grew steadily, following the arrival of several million new migrant workers. Between 2002 and 2010 the number of non-Italian citizens officially residing in Italy was up by 3 million (or 200%).

During this time the labour force grew by about a million:

while employment was up by around 1.5 million.

Yet GDP barely rose. In fact, since Italy left recession the number of those employed has hardly risen, while the percentage of those who are formally unemployed has remained near its crisis highpoint, which has been good for productivity, but not for consumer consumption. The ideal combination would be to see both output and employment growing in tandem, but with output growing faster than employment. At the present time employment is hardly growing, and the rate of increase in output is slowing notably. That is to say we do not have “lift off”.

Slamming The Debt Brake Pedal Down To The Floor Won’t Work

Despite the fact that the real leverage M Trichet now has over the Italian government is being exercised in order to obtain the constitutional change required for the balanced budget rule to be put in place, the severity of the fiscal tightening that Italy will now experience should not be taken lightly. In the first place something like 45 billion euros in new cuts will be implemented in 2012 and 2013, and this will be on top of the previously agreed package of 47.8 billion euros in cuts between now and 2014 agreed in the July budget.

In addition Italy will now aim for a general budget deficit no greater than 0.2% of GDP in 2013 (Germany will not achieve this result till 2016), and will maintain that ceiling into the indefinite future. Basically, this will mean the post 2012 Italian budgets will need to aim for an average primary surplus of just under 5% of GDP during the subsequent years, as the weight of the debt is gradually ground down, and the burden of interest costs reduced. This is a difficult, but not impossible task.Between 1995 and 1998, when Italy’s undertook its maximum effort to enter the monetary union, the average primary surplus was 5.0% of GDP. However, during the second half of the 1990s Italy was benefiting from both decreasing interest rates and also from the depreciation of the Lira. In addition the Italian government also implemented a significant privatization programme which helped to reduce the debt/GDP ratio. Most of these positive tailwinds will not be available this time round.

As Deutsche Bank analyst Marco Stringer puts it: “While there are no doubts that Italy needs to maintain a very prudent fiscal policy, there is a risk that an excessive fiscal consolidation could be counterproductive were it to have a significant negative effect on growth”.

There is a very real possibility that Italy’s fiscal consolidation, like Greece’s, is so sharp as to be counter-productive, with the low inflation, low growth and revenue shortfalls making it extremely difficult for the country to reduce to debt to GDP level, even if the ECB maintains 10 year bond yields around 5%. Writing in the Financial Times, International Monetary Fund managing director Christine Lagarde makes exactly this point. “We know that slamming on the brakes too quickly will hurt the recovery and worsen job prospects. So fiscal adjustments must resolve the conundrum of being neither too fast or too slow. Shaping a Goldilocks fiscal consolidation is all about timing. What is needed is a duel focus on medium-term consolidation and short-term support for growth and jobs”, she said.

So we really do now have a very high risk stand-off, with Monsieur Trichet and his colleagues holding the whip hand for the time being, as the threat to take the finger out of that dike concentrates attention on the issue in hand. But this upper hand has a definite sell-by date looming if the implementation of the debt-brake principal in a context of global slowdown (or recession) proves too severe for Italian voters to accept. Then the Italian politician’s fear of the penalty shot from someone on his own side might just become stronger, despite his apprehension before the technical superiority of M. Trichet’s footwork. In which case, someone should remind them over at the ECB that, as Paul Krugman puts it, “once once a country takes on the fixed cost of default, it might as well impose a big haircut on creditors”. As the United States discovered in Vietnam, it’s easy enough to get yourself bogged down in a mess, but a lot harder to extricate yourself from one subsequently.

This post first appeared on my Roubini Global EconoMonitor Blog “Don’t Shoot The Messenger“.

Comments are closed.