Swiss Franc Exposes Risks To Hungary Banking Sector, Sovereign Rating

By Win Thin

We’ve gotten some more clarity on the Hungarian government’s housing support scheme. Due to the unprecedented strength of the Swiss franc, implementation of the FX part has been moved forward one month to September from October. The main pillars of Hungary’s so-called Structural Reform Program (HSRP) announced back in May 2011 are (1) fixing exchange rate for foreign currency loans, (2) giving an interest rate subsidy, and (3) buying and building housing. The government estimates that the cost of the housing relief plan could run as high as HUF45 bln from 2011-2014, with HUF20 bln in 2012 alone.

The interest rate subsidy (2) can be requested by a debtor that sells a current home and moves into cheaper accommodations, and will be provided for up to five years. The government has capped the budgetary impact of this program at HUF6.0 bln. Under (3), the government will purchase homes from eligible debtors and then rent to those debtors. The government will also construct public housing for needy families. For purchasing and building, the government is budgeting HUF20.5 bln and HUF15 bln, respectively, through 2014.

The most unorthodox part of HSRP is (1), where the government and banks have agreed to offer household borrowers the option of fixing their foreign currency loan payments at an exchange rate of 180 until the end of 2014. The difference between that fixed payment and what they would have had to pay under the market-based exchange rate accrues in a Special Account that is HUF-denominated and carries a rate aligned to 3-month BUBOR. It remains the obligation of the debtor, but the government backs this with a State Guarantee, for which the creditor banks pay a fee. After the end of 2014, the accrued debt will then have to be paid off by the debtor.

The head of Hungary’s Banking Association admitted that bad loans have risen because of the strong Swiss franc, but unbelievably declared that the banking sector will be “stable” even if this cross rises as high as 300. According to central bank data, two thirds of mortgage loans are denominated in foreign currencies, mostly in CHF. That currency pair is currently around 250 after spiking as high as 272.6 earlier this week. We remain skeptical about the reasoning behind this most recent CHF weakness, and so believe that franc strength will reassert itself as euro zone pressures intensify again.

In the end, we think that the government is underestimating the costs of these programs and there will be a more significant negative fiscal impact. This also comes at a time where the fiscal performance is deteriorating, and revenue forecasts from privatizing state assets this year will clearly not be as rosy as expected. We doubt that the borrowers will be able to pay off the Special Account, which means the government will have to take on the obligations, the banks will have to write off the obligations, or we see a combination of the two. Any bailout for the household debtors will likely lead to deterioration in the sovereign standing. Our model shows Hungary currently at BB+/Ba1/BB+ vs. actual ratings of BBB-/Baa3/BBB-, and so we remain negative on the rating outlook. Back in June, Fitch moved its outlook for Hungary to stable from negative. Both S&P and Moody’s have maintained negative outlooks, and rightfully so.

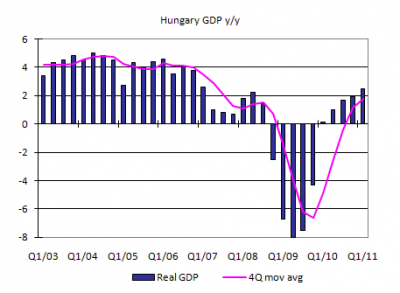

The fundamental backdrop is not encouraging either. While GDP growth accelerated to 2.5% y/y in Q1 from 1.9% y/y in Q4, a sharp slowdown appear to be under way. IP rose only 1% y/y in June, down from 2.3% y/y in May and a peak of 14.8% y/y in February. Retail sales rose 0.7% y/y in May, and follow two straight months of y/y contraction. Exports remain strong, rising 22% y/y in dollar terms. However, with exports (mostly going to EU) accounting for almost 75% of GDP, the ongoing slowdown in Western Europe is bound to have an impact soon. July CPI inflation came in much lower than expected at 3.1% y/y in July, and could fall beneath the 3% target in the coming months. Given this backdrop, we believe the next move from the central bank will be a cut in the policy rate from the current 6%. Timing is problematic, however, as ongoing DM turmoil and a soft forint are likely to delay easing.

EUR/HUF will ultimately be driven by external factors emanating from DM. Given our pessimistic view on the euro zone debt crisis, then, we would look to play this pair from the long side. We think the January high around 281 will be tested in the coming weeks, then the December 2010 highs around 285 (when Ireland blew up). EUR/HUF made some highs around 290 in June 2010 (right after Greece blew up the first time). Within CEE, we advise playing PLN/HUF from the long side too, though recent PLN underperformance is hard to explain on a fundamental basis. We look for a move back to May 2011 high around 68.80, and then ultimately the January 2011 high around 72.29.

The fact that so many Hungarian mortgages are in Swiss Francs is going to be a problem. With the surge in the Swiss Franc it will inevitably impose a huge burden on Hungarian borrowers. That could suck spending out of the Hungarian economy, Then if these start to fail, the ramifications are that Swiss banks have to start reporting higher loss provisions. If large enough this could alarm bank shareholders and regulators alike. Though I doubt that Hungary are the only eastern European nation in that state. A slow down in the EU could impact on the sustainability of these mortgages. When these defaults start hitting the Swiss bank balance sheets then we could see problems exposed within Switzerland. Maybe more attention should be placed on where the Swiss banks have made their loans.