Wynne Godley: Interest rates, growth and the primary balance

Nick Edmonds objects to my assertion that real interest rates should be at or below the real growth rate of the economy (my emphasis):

“Interest payments are just transfer payments, so their impact on stability has to be seen in the context of other transfer payments (principally taxes and benefits). Depending on the structure of these other transfers, there is no reason per se why the interest rate on safe assets has to be below the growth rate. (See for example https://www.levyinstitute.org/pubs/wp_494.pdf ) There is no public sector in Samuelson, so you don’t get these transfer flows, but by the same token his assets aren’t actually claims on anybody, so they can’t really be thought of as safe assets.

“Of course, it may be that excessive interest rates entail tax and transfer rates that are unpalatable, but that’s a different issue.”

I don’t think it’s a different issue at all. It’s the whole point. Not just “unpalatable”, but unsustainable tax and transfer rates are inevitable if real interest rates on safe assets are too high. And this has serious implications not only for the welfare of future generations, but also for economic stability and long-run growth. As Left Outside points out, real interest rates persistently above the long-term expected real growth rate are effectively a subsidy of current generations by future generations.

The paper Nick quotes in support of his argument that real interest rates above the growth rate is this one by Wynne Godley. Godley’s paper does indeed demonstrate that government debt dynamics can be stable with real interest rates far above the real growth rate. But that doesn’t mean that the economy as a whole is stable.

What Godley is saying is that in conditions of full employment, for the government deficit to stabilise after an interest rate shock, government spending adjusted for the new real interest rate must grow at the same rate as the economy. That is eminently sensible – though it is not the situation we have.

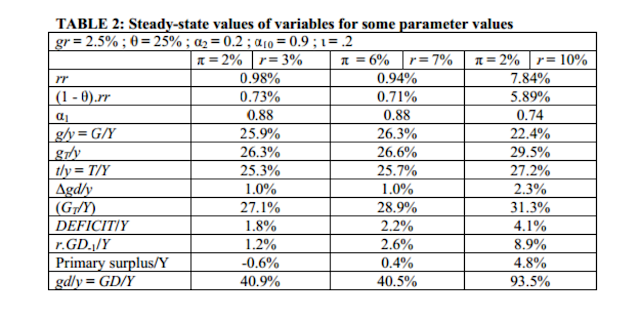

However, from the table of endogenously-determined variables on page 10 and Godley’s subsequent mathematical analysis it is clear that maintaining an interest rate persistently higher than the growth rate requires a primary surplus:

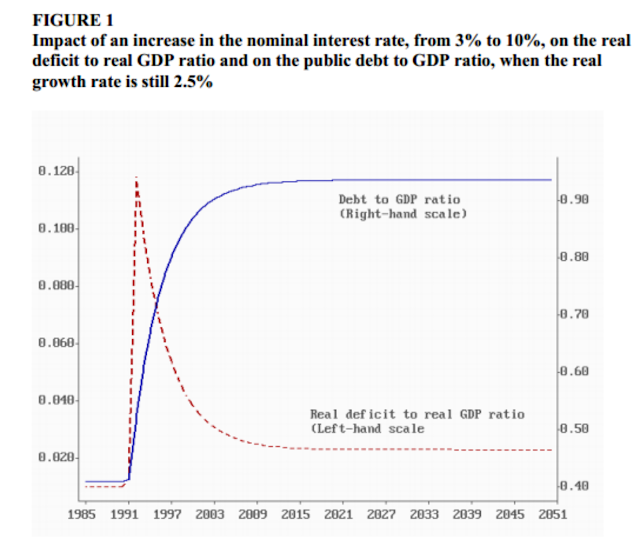

Note that this does not mean the debt/gdp level falls, as it would if government ran a primary surplus with real interest rates at or below the real growth rate. Indeed the debt/gdp level becomes very high, although it does eventually stabilise:

No, it means that a primary surplus is required purely in order to service the interest on the debt.

National income accounting requires that (assuming external trade is balanced) a persistent primary surplus reduces private sector saving.

Y = C + I + (G-T) + (X-M)

where Y = private sector income net of taxes, C = private sector consumption, I = private sector investment, G = government spending, T = taxes, (X-M) = net exports/(imports).

If X-M = 0 (trade is balanced),

Y = C + I + (G-T)

Clearly if G < T, i.e. the government is running a primary surplus, C + I must reduce if Y remains constant.

Private sector saving is the residue of income left after taxes and consumption, and for the purposes of this analysis we assume it is entirely invested in some way:

S = Y – T – C = I

So it should be obvious that if T is higher than strictly needed for government spending, then unless C reduces, S must fall. Persistently running a primary surplus means that the private sector must either reduce consumption or dis-save. We assume that labour is taxed more highly than wealth – this is generally the case in Western societies. So to maintain above-growth returns to holders of safe assets, income earners must be taxed more highly than required to meet government spending commitments.

Godley demonstrates that the required primary surplus becomes stable if interest-adjusted government spending is allowed to grow at the same rate as the economy. But it is still extracting more money from the private sector than it returns as government spending. Admittedly, the difference goes to the holders of government debt, some of whom will spend that money into the economy. If all of them did, it would be a wash. But not all of them will. Many (probably most) will save that interest rather than spending it, either by buying more assets or increasing funds in insured deposit accounts. It is therefore a wealth transfer from income earners (who are taxed on their labour) to asset holders (who are given a tax credit), most of which does not recycle back to the benefit of income earners but goes to increase the wealth of asset holders. This impedes the desire of income earners to save and causes widening inequality. As income earners tend to be young and asset holders old, it also impoverishes the young and enriches the old. If the asset holders lend their wealth to the young to enable them to buy consumption goods and/or assets, it creates a growing private sector debt burden which is ultimately unsustainable.

Note also that since S = I, deliberately maintaining interest rates at too high a level reduces productive investment in the economy, since it limits the saving of income earners. The desire of asset holders to have positive risk-free real returns even in a recession therefore impedes recovery and limits the growth potential of the economy. Which is unfortunate, because risk-free real returns above the real growth rate are an open punt on the future growth rate of the economy. In effect, they are saying that although we aren’t generating enough at the moment to pay those returns, we will manage to do so in the future even though we are making it damned hard for anyone to invest in order to generate growth in the future.

But Godley’s baseline model (pages 9-10) actually has a real interest rate below the growth rate of the economy (inflation 2%, nominal interest rate 3%, growth 2.5%). And under these conditions, the government needs to run a primary deficit in order to maintain a stable supply of safe assets. This is is because with a balanced budget and positive real growth matched by an equally positive real interest rate, debt/gdp naturally falls over time. The maths to prove this is on pages 11-12 and Godley explains it thus:

“…..it is rather obvious that an increase in the real rate of growth of the economy, accompanied by an equal increase in the real rate of interest net of tax, will lead to a decrease in the public debt to GDP ratio, as long as the propensity to spend out of disposable income is higher than that out of wealth. Only when the growth rate of the economy gets down to nil—the stationary state—should the real deficit become zero and the real budget be balanced.”

Godley further shows that under all scenarios, debt/gdp stabilises at some combination of interest rate, growth rate and primary deficit/surplus – provided there is full employment. So debt/gdp does not “spiral out of control” if government produces as much of it as people need in order to save. On the contrary, in my view government creating a plentiful supply of safe assets is essential for financial and economic stability. Deliberately restricting the supply of safe assets by, for example, running a primary surplus in combination with low interest rates (so debt/gdp falls) causes instability: when government doesn’t create enough safe assets, the private sector creates faux safe assets, which give the impression of being safe when they are not and are consequently mispriced. When the inadequacy of private sector “safe assets” is exposed, there is a violent crash and a flight to real safe assets, creating bubbles. The 2008 crash was not caused by investors seeking too much risk: it was caused by investors looking for safety, and the private sector attempting, and disastrously failing, to provide it.

But of course we don’t have full employment, so our ability to support even the safe assets we already have is curtailed, and lots of people are struggling to maintain essential consumption because their incomes aren’t high enough. For these people, saving is a distant dream. Maybe that’s what we should be concentrating on, really.

UPDATE. Ramanan points out (see comments) that in Godley’s model the increase in debt/gdp is due to fiscal policy designed to create full employment, and that the fiscal surpluses are a consequence of higher fiscal activity arising from full employment. I don’t disagree. But I was looking at the steady-state after full employment is achieved.

It is distinctly possible that the high interest rates in scenario three are a consequence of the very high debt/gdp level (over 90%) required to achieve full employment. But if that is the case, then government debt in that scenario can’t be considered risk-free: the high interest rate represents the increased default risk associated with such a high debt/gdp level. This is entirely different from Nick’s argument that risk-free interest rates can be sustainably above the long-run growth rate.

Comments are closed.